I’ve mentioned several times that we started a new Bull Market in July 2016 after Brexit. Since then, the parallels to 1995-2000 continue to be very similar and I feel we are in year two of what could be a five year (or longer) Bull Market. I am basing my theory on the price action of leading stocks, sentiment, and the concept that moves in the stock market can go on for much longer than people expect.

Here’s the biggest catch: WE WILL SEE MUCH MORE VOLATILITY GOING FORWARD. Last year was unusual because the market didn’t see a -3% correction all year. Historically, this was a very rare occurrence. We will most likely go back to the normal 10-15% intra-year corrections that we have typically seen over the past 80 years. The biggest question is how does one adjust for the higher volatility? If you are a long term investor, you will most likely do very little and ride out the waves. If you are a trader, one suggestion is to take profits into strength and keep some cash available for the inevitable pullbacks. Another suggestion is to reduce your position size so you don’t get “chopped up” by the volatility.

90% of my Bull Market theory is based on the price action of leading stocks. I am finding many strong fundamental companies that continue to expand their profit margins and show great technical qualities. Many of these stocks ARE JUST STARTING to accelerate their earnings and sales growth, mainly due to international expansion. The growth sectors I am mostly focusing on include Technology, Enterprise Software, Semiconductors, Payment Processors, and Biotech. If we were heading into a Bear Market, these riskier growth sectors would not be leading.

Regarding sentiment, nothing has changed. This continues to be the most hated Bull Market in history. The majority of people consistently have one foot out the door, and every time we see a quick correction they rush for the exits. It is not euphoria when sentiment measures spike to extreme levels on every minor pullback. Furthermore, most people who I have discussed this theory with think I’m crazy and feel this Bull Market will end any day now. The thought of a few more years of upside is mind boggling to most people.

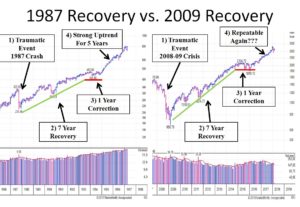

The chart below shows many similarities between the 1987 recovery and the 2009 recovery. After a one year correction in 1994, the stock market accelerated from 1995-2000 with 1995 being a very low volatility year (similar to 2017). After that, the market took off but saw enormous volatility in 1997 and 1998. I feel the same thing will happen over the next few years.

One last note: The media keeps saying we’re in the 9th year of a Bull Market. This is incorrect because we had a -22% correction in 2011 and a Bear Market from mid-2015 to mid-2016 that very few people talk about. Either way, I recommended focusing on the price action of the leaders and shutting out all the other noise. Focusing too much on the news might distract you from great opportunities over the next few years.

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.