There is something big going on in the stock market. It’s something bigger than most people realize. I like to call it The Perfect Storm. It’s a favorable combination of technicals, fundamentals, global growth, interest rates, sentiment, a pro-business government, and a new technological revolution.

The reason I’m excited about it is I’ve been around the market for 20 years and I’ve learned that you have to take advantage of these healthy situations while they last. In other words, when this Bull Market is over, it will turn ugly and stay ugly for a while. There will most likely be a period of 6 to 18 months where it will be very difficult to make money and many people will give back the majority of their gains. The problem is I don’t know if this current bull will last for another three weeks, three months, three years or longer. I’m leaning towards the longer time frames for the following reasons:

1) Technicals – I constantly remind people that the big institutions control the market. That’s why it is so important to follow what they are doing on a daily and weekly basis. When they are buying, ride the trend with them and when they are selling, get out of their way. Since we resumed this new Bull Market in July 2016, the institutions continue to accumulate shares. When we do see some selling, it is usually normal declines down to logical levels of support, and then the institutions step in and buy again. In addition, the market has been INCREDIBLY resilient and doesn’t stay down after any bad news. Almost as if it knows there is something bigger going on.

2) Fundamentals – Many companies are just STARTING to accelerate their earnings and sales. Bears say that valuations are too high but keep in mind the market is a discounting mechanism. It tends to trade on what will happen 6-12 months from now. In other words, current valuations can be justified if earnings continue to accelerate into next year. The Bears also base their overvaluation thesis on historical Price to Earnings (PE) ratios. This is challenging because there’s not enough data. For example, before 1997, the S&P 500 had an average PE of 13.95. Since 1997, it has averaged 23.36. That’s a HUGE difference! We probably need hundreds of years of data before coming up with any meaningful conclusions about PE. I feel that PE ratios are now higher because profit margins are expanding, there are fewer stocks in the market, and there is more money globally that wants to be invested in the US markets. This last part is crucial. So many international clients I speak to want their money in the US because it’s the most stable market and it offers more opportunities than their own country’s stock market.

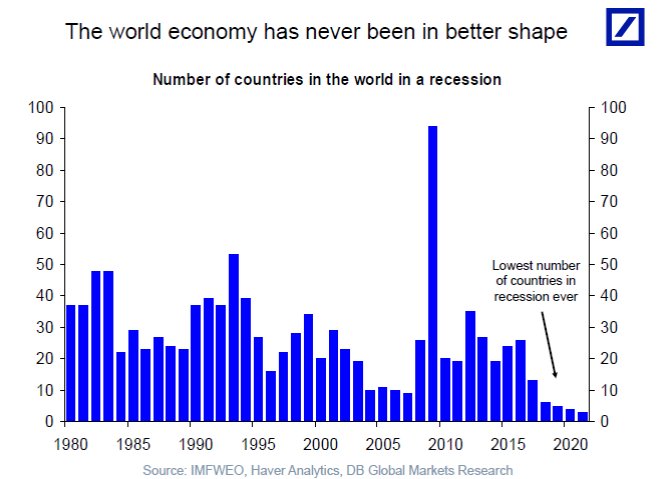

3) Global Growth – Part of the reason for the acceleration in earnings and sales is that we are no longer just a domestic economy. The majority of revenues for many S&P 500 companies are coming from overseas. Remember all those third world and emerging countries from years ago? Many of them are now well developed. They have strong infrastructure build-outs and operate with state of the art technology. In addition, their economies are strong. The chart below shows that we currently have the lowest number of countries in the world in a recession.

4) Interest Rates – We are still in a globally coordinated effort to keep interest rates low and the markets high. As I have been saying for a long time, this rate friendly environment will continue to give the market the backdrop it needs to grind higher. There’s an expression on Wall Street: “Don’t fight the Fed.” So, good luck fighting all the globally coordinated Feds. As David Tepper said: “Talk to me when the 10-year gets to 4%.”

5) Sentiment – The majority of people still hate this market. Even the bulls are scared. You can see it every time we have a short-term selloff. Sentiment indicators spike to extreme bearish levels and many people RUSH for the exits. They do this by either selling positions, buying puts, shorting stocks, buying those toxic VIX products, or raising cash. For example, the Thursday before Hurricane Irma hit Florida, the CBOE Index Put/Call ratio hit its highest level in 7 years! The media made it out like Florida would fall into the ocean and the end of the world was near. If you don’t believe me about the current skepticism, go ask 10 random people what they think of the stock market and you’ll see exactly what I’m talking about. I understand that no one wants 2008-09 to happen to them again, but this constant fear is a generational mentality that will take a long time to change and could be another reason why the market continues higher over the longer term.

6) Pro-business Government – The mainstream media constantly undermines President Trump and tells the public that he won’t get anything accomplished for the next four years. Any progress made by the government is not priced into the market and could be a significant catalyst over the next few years. This includes progress in corporate tax reform, personal tax reform, health care reform, tax cuts, repatriation of foreign money, and infrastructure plans. For example, a reduction in the corporate tax rate can add $10-$15 in earnings to the S&P 500 and easily spark a 10% move higher. You might be thinking “What if nothing gets done?” The stock market can still perform well because of the amazing inventions that continue to revolutionize our lives (which I discuss in the next section). Right now, the concept of less regulation and a more business friendly government is fueling strong optimism among many business leaders.

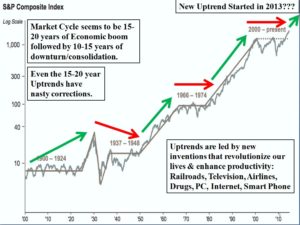

7) Technology Revolution – For the past 100 years, the market’s pattern has been approximately 15-20 years of an economic boom followed by 10-15 years of a downturn or consolidation. This current cycle looks to have started with the new highs created in 2013 and could last for many years. These cyclical uptrends are usually led by new inventions that revolutionize our lives, enhance productivity, and completely change the way we do things. In our current market, this includes smart phones, autonomous cars, machine learning, artificial intelligence, and the “Internet of things.” Experts estimate that we will see over 50 billion connected devices by 2020. These tremendous changes in technology are helping companies to drive growth and increase profit margins.

Here’s the catch: The move higher will not be easy. There will be corrections, shakeouts and pullbacks along the way. Many of them will be sharp and VERY convincing that the Bull Market is over. For example, even during the great bull market of 1995-2000, there were big corrections in 1997 and 1998 during the Asian economic and Russian debt crises. In fact, the correction in Sept/Oct 1999 had many people (including myself) thinking the bull market was over…right BEFORE it recovered and went on one of the most amazing six-month runs in market history! The biggest challenge for investors will be navigating through this. In other words, it will require a good balance of taking profits along the way up and having conviction during the corrections.

There is one final point I would like to make: In my 20 years of experience, I’ve learned that moves in the stock market can go on for much longer than we expect, however, I am NOT a blind bull. If I am wrong about this call, I will simply cut losses because capital preservation is ALWAYS the number one priority for my clients. One of my biggest strengths is my ability to make decisions and change my mind when market conditions call for it. If you think I’m being too optimistic about my call, remember that two things are almost always true: 1) The world keeps getting better and 2) The people always think it’s getting worse.

I can be reached at: jfahmy@zorcapital.com.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this video constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this video. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.